Account Intelligence Data for all your SMB prospecting–that’s a big promise to make–and we take immense pride in excelling at it!

While AID is needed in every aspect of a SMB-centric GTM play, it shares a core responsibility in correctly and comprehensively defining your ICP.

Every business is unique in their approach and considerations regarding how they define their ICP. We can only standardize the process insofar as to deliver high quality Account Intelligence Data to B2SMB vendors to suit their unique business needs. To that end, we work endlessly to expand on the data/signals that we ingest, curate and process–to maintain the largest proprietary database of SMB data and make available to businesses like yours either through the BuzzBoard platform or via direct integrations to your CRM.

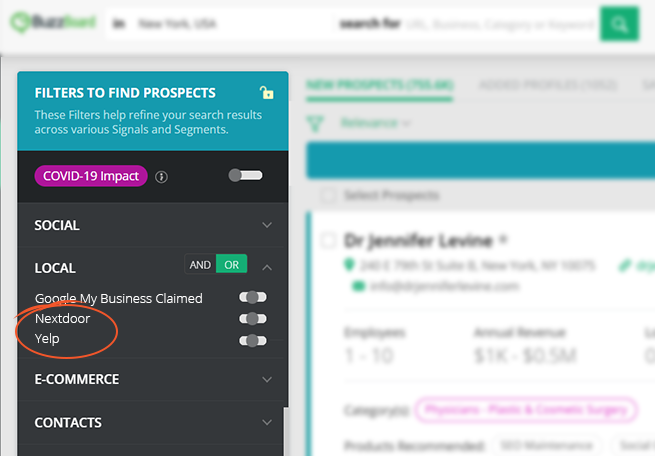

For the purpose of this article we will focus on the Local Business Presence cluster of signals in BuzzBoard that features the presence and engagement of SMBs on online directories and marketplaces such as Yelp and HomeAdvisor, along with some key signals from their profiles including if they are advertising on these platforms. These signals are very resourceful in assessing the local exposure and credibility of small businesses, depending on the categories you serve.

Signals Cluster re: Local Business Presence

With the advent of multiple marketplaces and directories, small businesses have the unprecedented opportunity of leveling up in reaching wider audiences than they otherwise would, thereby increasing their appetite and need to consume more technology and digital services to sustain growth.

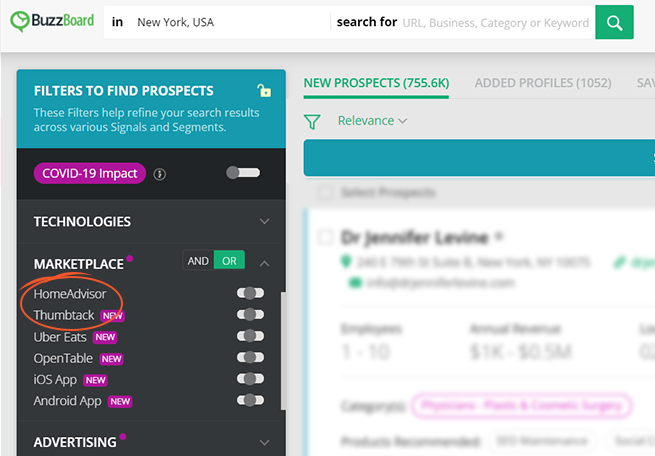

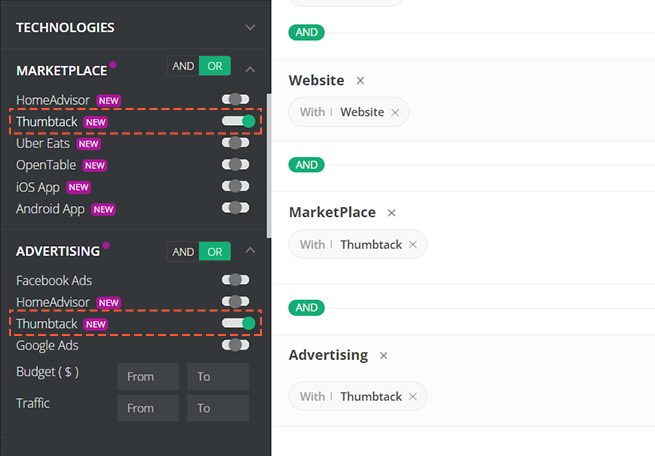

Taking our signal stack deeper into surfacing marketplace presence and ad spend insights as an ICP attribute/ scoring criterion, we now offer a wider range of SMB account data to profile small and mid-sized businesses.

We recently announced the addition of Nextdoor signals to this cluster and, taking it even further, we have a strong lineup of other marketplaces—ZocDoc, Thumbtack, Uber Eats, and OpenTable, to name a few—that we’ll be adding to our signal stack soon!

Insights about Marketplace presence and ad spend can be leveraged throughout the marketing and sales lifecycle, adding value at each step of the way.

Some strategic use cases include:

- Determining TAM (Total Addressable Market)

- Target Market Segmentation

- Life Time Value Analysis across segments or

- Individual SMBs

- Account renewals and upsells

While SMB marketplace and advertising related data can find many uses depending on the solution you offer, one of the arguably most compelling use cases is for media companies looking for small/local business (potential) advertisers.

It’s time to let go of the old way of finding local business advertisers – Embrace the modern era of data mining and prospecting

At BuzzBoard, we have been very strong advocates of the fact that a) advertisers beget more advertising budgets (we will get into the weeds in a bit), and b) access to data fosters a sustainable path forward for media companies inr finding and servicing small/local business advertisers.

More often than not, companies selling digital and ad services, and even cloud solutions to small and mid-sized businesses take a category sales approach, i.e. they align their sales and marketing efforts across specific verticals/categories such as home improvement services, financial and legal services, dental clinics, etc.

The coming together of marketplace data for a myriad of marketplaces (some more vertical specific while others more generic) exposes the needs of SMBs and surfaces the opportunity to bring them into your TAM.

Advertisers beget more advertising budget

For example, publishers looking for advertisers in the home improvement services vertical can now holistically assess the acquisition/revenue potential of businesses even before including them in their target account list.

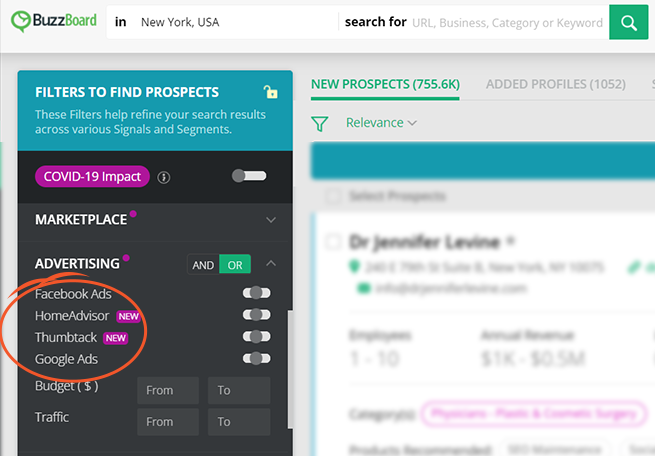

Insights into ad spend across traditional digital channels such as Google and Facebook together with spends across online directories and marketplaces such as Homeadvisor, Thumbtack, and Yelp will give you an unparalleled access to finecombing your TAM, helping you –

- Make sure you have all such business prospects in your TAM.

- Score the businesses on the basis of how many platforms they advertise on.

- Segment them at a micro-category level and other business attributes that best suit your ICP

- Create a segment of businesses who are not advertising on marketplaces just yet, but otherwise have an ad budget.

Selling into Home Services Using Thumbtack Signals

Thumbtack is an online directory that allows users to search for, rate, and hire local service providers to work on a variety of personal projects, including home improvement, financial and legal services, as well as event planning. With the new Thumbtack signals, BuzzBoard can help you understand more about the presence and relevant details of local businesses as it relates to their audience outreach and advertising on this directory.

With these signals, media reps can easily assess if the businesses they are prospecting into have positioned themselves as trusted partners in the Thumbtack marketplace. Additionally, according to Thumbtack, the trusted pros that show up in search results have paid to appear on the site–strong indicators for both a budget and a belief in advertising, making conversations easier to have.

Both Thumbtack and BuzzBoard allow users to filter for businesses by Zip Code. Reps can, therefore,

- Search out the most densely populated zip in a market in both Thumbtack and BuzzBoard.

- Identify the top pros listed in Thumbtack.

- Engage with the businesses found on BuzzBoard that are NOT listed on Thumbtack.

When BuzzBoard indicates that a business is not listed in the Thumbtack marketplace, reps have the ability to:

- Leverage the Competition report in BuzzBoard, showing the prospect how other competitors are enhancing their presence by working with Thumbtack.

- Introduce their digital offerings that are designed to maximize the prospect’s exposure online and generate better leads.

“Did you know that you are losing market share and potential revenue to XYZ Roofing right now? Let’s take a look at how I can help you counter this.”

This new (data-driven) approach to prospecting already exists—we just need to embrace it, allowing us to reach advertisers more meaningfully and helping them with solutions that best meet their needs.